Debt/EBITDA Ratio

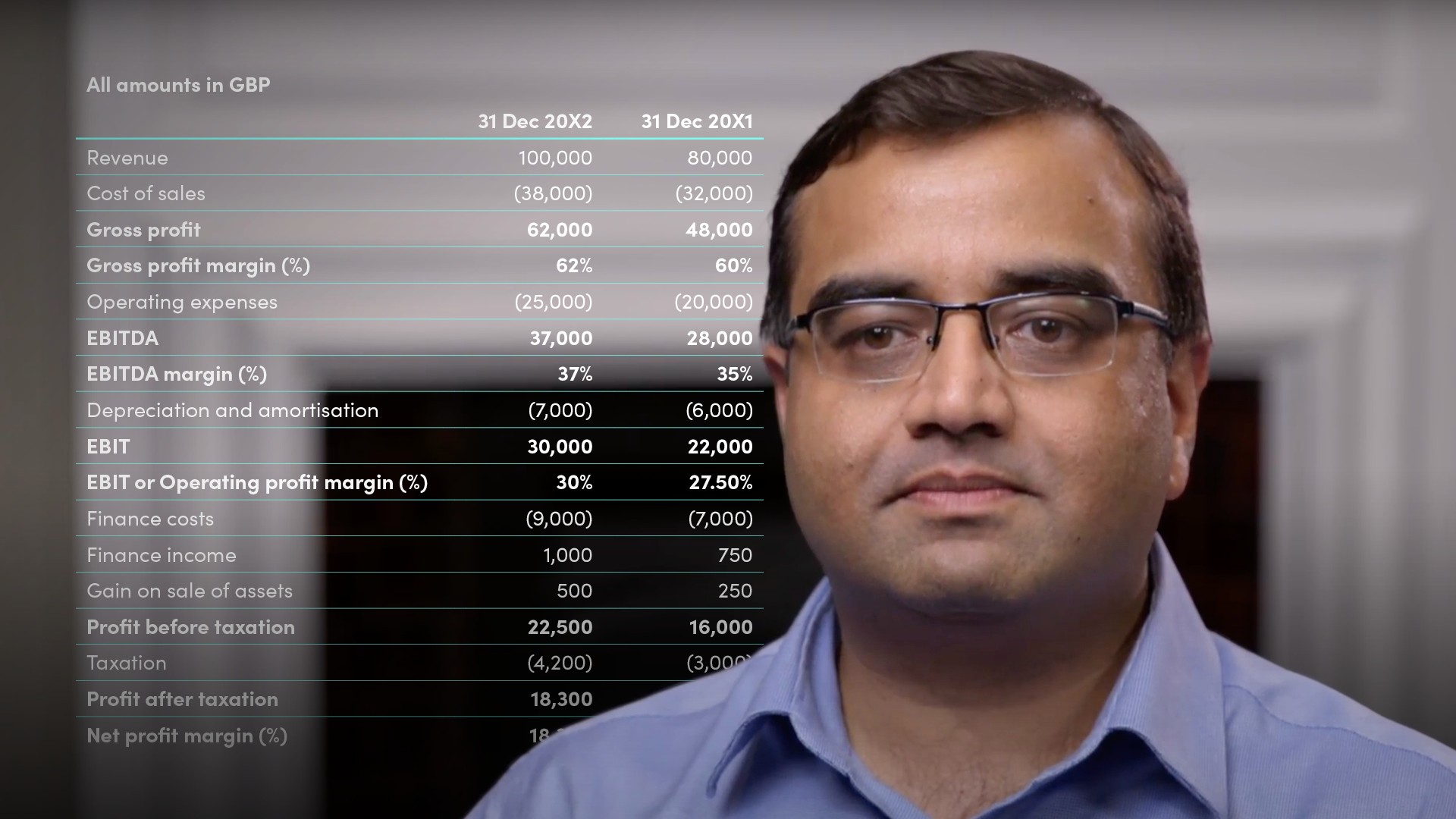

A company’s debt-to-EBITDA ratio is one of several leverage measures used to determine how much income a company has at its disposal for servicing its debt. It is calculated by dividing total interest-bearing debt by EBITDA (i.e. earnings before deductions for interest, tax, depreciation and amortisation). Lenders, particularly to companies with low credit ratings, will typically include covenants that cap debt-to-EBITDA multiples. Rating agencies often use debt/EBITDA ratio as an input into its rating decision.